The Financial Distress of Divorced Boomers: A Cry For Revised Settlement Norms

In the wake of an increasing rate of late-in-life divorces, a disturbing financial narrative is coming to light. The divorce-tide, often referred to as “grey divorces,” has been steadily rising among baby boomers, leading to far-reaching implications on their financial security and retirement savings, particularly for women.

The Financial Impact of Late-in-Life Divorce

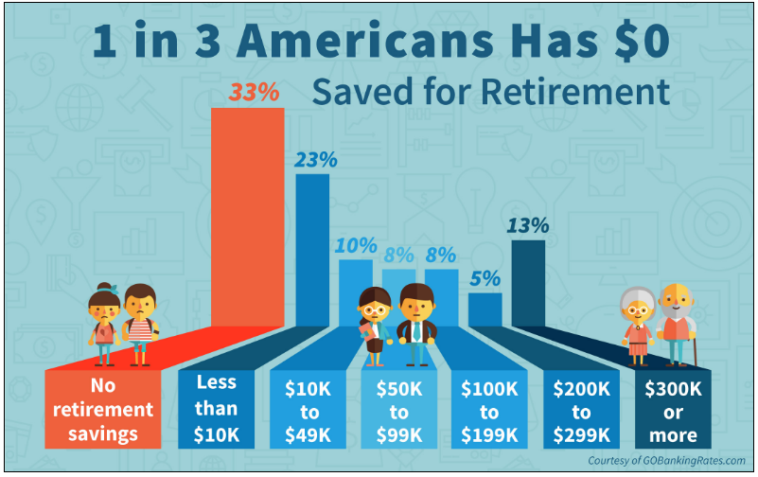

Divorce inevitably disrupts immediate finances, but the latent shockwaves it sends into a couple’s retirement plans can leave many on the brink of financial distress during their twilight years. This negative financial impact is often intensified for women, as they tend to receive lesser assets in divorce settlements, thus diminishing their retirement security.

A Hard Reality Post-Divorce: Paralegal Libby Mintzer

Libby Mintzer is a poignant example of the heartbreak many boomers face post-divorce. As a paralegal who focused on her financial future throughout her career, she envisioned her retirement as a peaceful and enjoyable time with her husband. However, a divorce imploded her retirement plans, leaving her grappling with life on limited savings. With her monthly Social Security benefits amounting to a modest $1,600 and without any spousal support, Mintzer finds herself cornered financially.

Retirement Hurdles for Divorcees

Divorcees entering retirement face unique financial hurdles. Many are forced into early retirements due to fiscal strain or health problems, and in turn, rely on lower benefit amounts that fall short in meeting growing living and housing expenses. A 2022 study published in the Journal of Gerontology reveals an increasing trend of late-life divorces, indicating a rise in older adults experiencing prolonged financial effects due to divorce.

Shared Assets, Divided Futures: How Divorce Affects Wealth Management

Married couples can often boast higher retirement savings due to combined income and shared assets such as properties and investments. However, these assets, when divided in a divorce, significantly dent each individual’s financial stability. While prenuptial agreements can provide some clarity in terms of asset division before marriage, they only protect pre-marital assets, leaving wealth accumulated during marriage vulnerable.

Women and the Post-Divorce Financial Challenge

Women face peculiar challenges in the wake of a divorce. They often bear a more significant financial burden compared to their male counterparts. Despite making strides in the workplace, women have a consistently lower income compared to men, making them more susceptible to financial instability post-divorce. This financial divide is particularly stark amongst boomer women who were denied access to credit cards before the 1970s, and often spent years outside the workforce managing households.

The Impact of Custody on Divorced Women

Divorced women, especially those assuming primary custody of children, confront even more challenges. Striving to balance financial responsibilities with limited income in retirement, these women struggle to make ends meet, illustrating an inherently flawed system that demands urgent change.

The Imperative Pursuit of Financial Independence

The narratives of women like Mintzer and Clark underscore the critical importance of financial independence for women across their lifespan. A sudden loss of assets and income resulting from a divorce can leave individuals financially vulnerable, particularly those without independent savings. It is critical, therefore, that women are encouraged to prioritise their financial future, regardless of their marital status.

Originally Post From https://www.inkl.com/news/divorced-boomers-struggle-with-40-less-in-retirement-savings-why-women-lose-more-in-settlements

Read more about this topic at

The impact divorce has on retirement savings – Michigan Legal …

Emotional Effects of Divorce on Men – anger and healing – Jon Dabach