The Hidden Costs of ‘Grey Divorces’: How Divorced Boomers Face Retirement

As the rate of late-in-life separations, often referred to as “grey divorces,” rises amongst the baby boomer generation, the impact on their financial security, particularly in retirement, is becoming increasingly evident. This financial upheaval is often more severe for women, affecting their retirement security even more compared to men.

A Financially Shattered Retirement Dream: A Case Study

These implications can be illustrated clearly through the experience of Libby Mintzer, a 73-year-old former paralegal who’s struggling to survive on limited savings post-divorce. Unfortunately, Mintzer’s circumstances are not uncommon among her peers. Like many of them, she invested her time and money in the service of her spouse, compromising her financial stability in the process.

Financial Impact of Divorce on Retirement

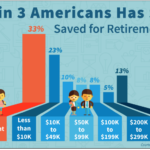

The financial implications of divorce on retirement are considerable. Data from the Social Security Administration reveal that for a multitude of divorcees, their early retirements, either by choice or due to health concerns, have them relying on lower-than-average benefits. This is insufficient to meet the demands of rising living and housing costs. The repercussions of this are further amplified by a rise in late-life divorces.

The Effects of Dividing Assets and Futures

Typically, married couples have higher retirement savings due to combined incomes and shared assets, which include properties and investments that are usually divided in divorce. This wreaks havoc on their financial cushion, underscored by wealth management advisor Melody Evans, who explains that the division of assets during divorce settlements drastically reduces the retirement savings of divorced individuals.

Women and the Financial Burden of Divorce

Women often face unique challenges in the aftermath of divorce, shouldering a more significant financial burden compared to their male counterparts. They are more susceptible to asset ignorance, reflecting a lack of awareness regarding joint assets. This leaves the women vulnerable during divorce proceedings. Furthermore, women traditionally have had less access to credit and have spent years out of the workforce managing households, leading to a persistent income gap.

Navigating Custody and Financial Strain After Divorce

For women assuming primary custody of children post-divorce, the financial situation worsens. Without substantial retirement savings, constantly dealing with financial strain becomes the norm, as demonstrated by Kathryn Clark, an 80-year-old retiree.

The Importance of Financial Independence

The stories of Mintzer and Clark highlight the crucial need for financial independence, especially for women. A sudden loss of assets and income due to divorce can financially cripple individuals who do not have independent savings. Mintzer’s advice to younger women is profound: “Don’t rely on someone else—whether it’s a husband, wife, or children. From the day you turn 18 and start working, start preparing for that day when you’re not going to be working anymore.”

Originally Post From https://www.inkl.com/news/divorced-boomers-struggle-with-40-less-in-retirement-savings-why-women-lose-more-in-settlements

Read more about this topic at

Divorce After 50: The Impact on Retirement Savings

How Does a Divorce Affect Your 401(k) & Retirement Assets?